Eurazeo Entrepreneurs Club 3

Asset class

Strategy

Geography

Sector

Technologie

Risk index (SRI)

6/7

Eligibility

Nominatif pur, Compte-titres

Taxation

Eligible au 150-0 B Ter / Exonération d'IR sur les plus-values à l'échéance / IS au taux réduit de 15%

The Entrepreneurs Club 3 (EEC 3) fund aims to invest in the capital of fast-growing European digital tech leaders looking to accelerate their expansion.

The companies selected by Eurazeo are among the leaders of the European market. They have already reached a significant size, with an enterprise value in excess of 100 million euros, and require both development financing and high-level strategic support. They are growing fast, with revenues increasing by 20% to 30% a year. They are led by an experienced team and offer innovative, recognized products or services that are widely adopted by consumers.

This FCPR is tax-eligible under the 150-0 b Ter mechanism of the French General Tax Code.

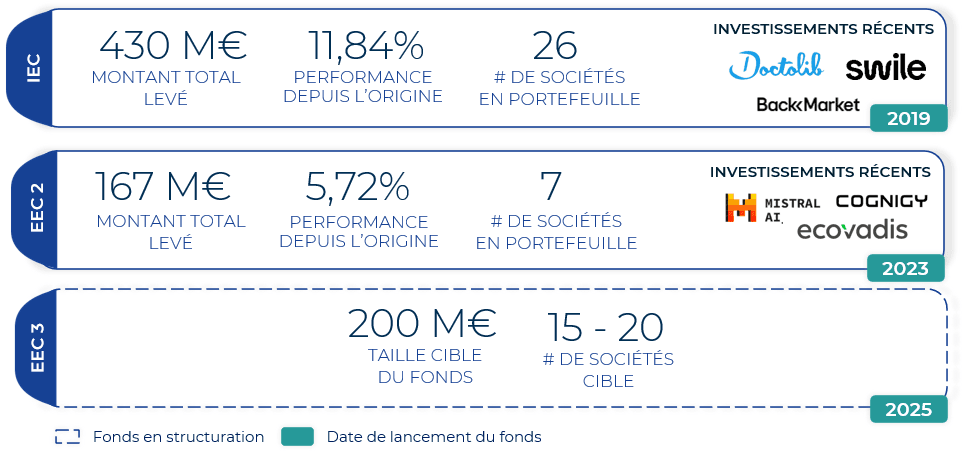

The EEC 3 fund is part of Eurazeo's €2 billion investment program in the European growth equity market. Eurazeo invests between €20m and €100m per company as part of this strategy. Eurazeo Entrepreneurs Club 3 systematically co-invests with our funds dedicated to institutional clients. Through this parallel investment mechanism, the fund's private investors have access to investment opportunities usually reserved for institutional investors, as well as to the same management quality guaranteed by Eurazeo.

Eurazeo is a major investor in French and European tech. Thanks to an investment team of 16 experts and a pan-European presence, the group is today one of the main shareholders in 11 of the 24 French unicorns (Tech companies valued at over €1 billion) and 25 "Next 40" companies.

Sample of companies financed by Entrepreneurs Club funds. Past investments are no guarantee of future investments.

In particular, the group accelerates the growth of companies in targeted tech sectors (Fintech, SaaS, B2B and B2C marketplaces, digital healthcare, etc.). With this in mind, we support entrepreneurs in their external growth operations, structuring their business, expanding into new markets and recruiting the best talent.

Data as of 12/31/2024.

Investors are invited to consider all the risks inherent in investing in Fund units, which are detailed in the Fund regulations. The risks listed below are an extract of those mentioned in the regulations:

Risk of capital loss. An investment in the Fund entails a risk of low return or even partial or total loss of the amount invested in the Fund. In addition, as the Fund offers no capital guarantee, the capital invested may not be returned in full.

Risk of illiquidity of the Fund's assets. The Fund will mainly hold securities that are not admitted to trading on a financial instruments market, and whose liquidity may be low or non-existent. As a result, and although the Fund's objective will be to organize the disposal of its holdings under the best possible conditions, it cannot be ruled out that the Fund may experience difficulties in disposing of such holdings within the timeframe and at the price level desired or initially envisaged.

Risks inherent in all equity, quasi-equity and mezzanine investments. The purpose of the Fund is to provide immediate or long-term equity financing for companies. As a result, the Fund's performance is directly linked to the performance of the companies in which it invests, which are subject to numerous uncertainties such as: downturn in the business sector, recession in the geographical area, substantial changes in the legal and tax environment, unfavorable exchange rate trends, etc.

Taxation. Tax treatment depends on the individual situation of each investor, and the arrangements presented are subject to change at a later date. Investors should consult their own tax advisors before investing.

The SGP may decide that it is in the best interests of investors to extend the life of the fund beyond the scheduled date.

Past performance is no guarantee of future performance. The number of investments and the target performance are only management objectives.